✅ Advantages of Investing in the Stock Market

1. High Potential Returns

-

Historically, stocks provide 7–10% average annual returns (long-term), higher than savings accounts, bonds, or gold.

2. Ownership in Companies

-

You own part of a business (like Apple, Google, or Tesla).

-

If the company grows, you share in the profits and value increase.

3. Dividends (Passive Income)

-

Some companies pay dividends, which can be reinvested or used as steady income.

4. Liquidity (Easy to Buy & Sell)

-

Unlike real estate, you can buy or sell stocks quickly with a click.

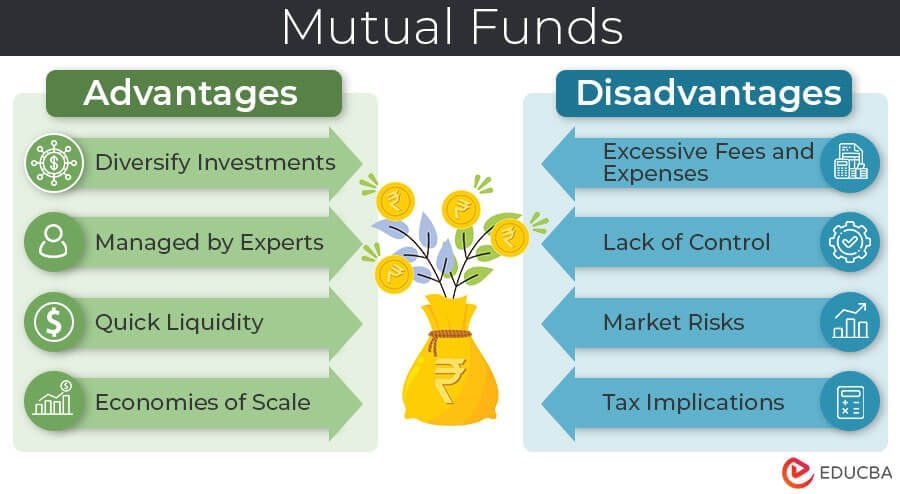

5. Diversification Options

-

You can invest in many industries, countries, or funds (ETFs, mutual funds) to spread risk.

6. Compound Growth

-

Reinvested profits grow on top of previous profits → wealth multiplies over decades.

7. Beats Inflation

-

Stocks usually grow faster than inflation, protecting your money’s value.

❌ Disadvantages of Investing in the Stock Market

1. Risk of Loss

-

Stock prices can go down (sometimes sharply).

-

You could lose part or all of your investment if a company fails.

2. Volatility (Ups and Downs)

-

Prices change daily due to news, economy, or investor emotions.

-

Short-term investing is risky.

3. No Guaranteed Returns

-

Unlike a savings account or government bond, returns are not fixed.

4. Emotional Stress

-

Fear and greed can cause panic selling or overbuying.

-

Requires discipline and patience.

5. Knowledge & Research Needed

-

Choosing the right stocks takes time, research, and understanding.

-

Many beginners lose money by chasing “hot tips.”

6. Market Crashes

-

Crashes (like 1929, 2008, 2020) can wipe out value temporarily.

-

Long-term investors usually recover, but it can take years.